The number of bankers reaching out with bridge rounds for startups that have raised ₹100+ crores but have run out of money astonishes me. How does a company (since these are no longer startups) run ‘out of money’ after having such a large cash pile? It begs the obvious question – are these companies adequately prepared for their financial challenges?

The Importance of Financial Management in High-Growth Sectors:

I could empathize with the founders if these companies were in spaces like MedTech, SpaceTech, and DeepTech, where large amounts of capital are required to finance R&D and get governmental approvals. However, these are companies in D2C, EdTech, FinTech, etc., where sales occur daily in most cases. The traction should have been exciting enough to value the companies at the levels that attracted the kind of capital they raised.

Responsibilities of a Finance Team:

Any company that gets valued at that level of maturity to raise that sort of capital should have a finance team to manage its finances. The board should have appointed a CFO or super-senior professional with a team to report the financial situation to them directly. That team and person's responsibility would be to:

1. Look at the variance between the budgeted plan and the actual results, and update the budgeted plans based on the actual results.

2. Put up a red flag when the money going out of the bank accounts is consistently faster than what the sales team can replace.

3. Sound the alarm when the money left in the account is less than the time it would take to raise a new round.

4. Start spending cuts, hiring freezes, and other measures when the runway left is less than 6 months, i.e., the business cannot sustain the cost of growth, and without fresh capital, it needs more time to extend the runway (remember it takes 6 months to raise a round!)

5. Start laying off people, give out termination notices for leases, etc., when the runway left will be less than the notice period for the staff or for terminating long-term contracts, etc.

6. Ensure there is enough capital to shut down the company if nothing can get done to turn it around.

The Impact of Financial Mismanagement:

These check-dams would ensure that the company management and board would be fully aware of the impending situation as they got closer to the inevitable, i.e., the day the coffers ran dry. Of course, no one starts a business intending to run it into the ground. Still, companies that have raised massive rounds of capital affect the lives of thousands, if not lakhs, of people, not all of whom may be direct team members.

Founders' Responsibility:

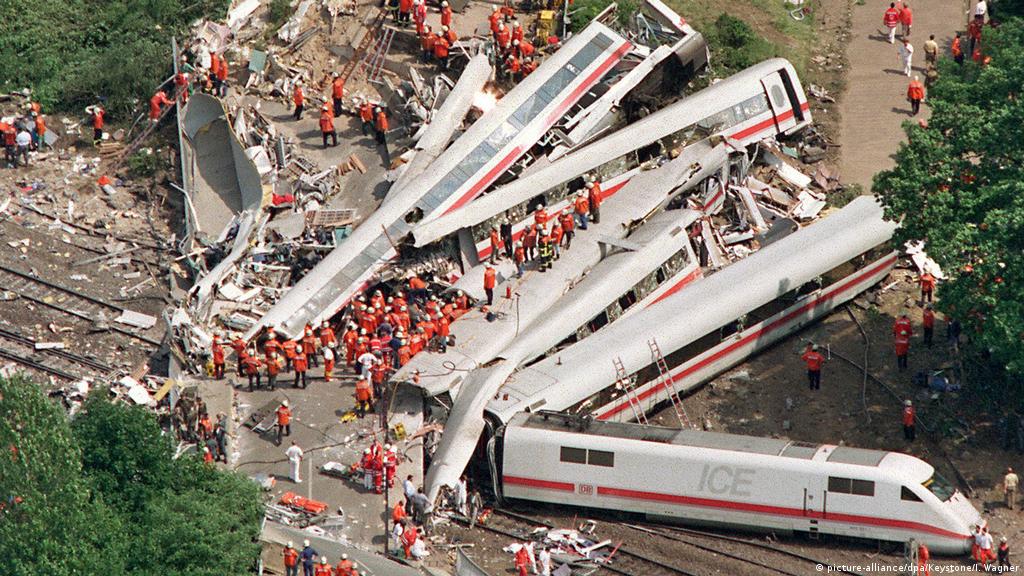

Any founder worth their word should not be playing with the livelihood and trust of those around them when it is increasingly clear that the real-life results do not match the plans. Instead, what I am witnessing through these bridge-round conversations are unmanned bullet train slamming into a wall at full speed, creating a massive pile of mangled metal and dead bodies strewn all over the landscape. It is sickening to be that founder, but even more sickening to the person who trusted that founding team, the management, and the board to take care of their livelihoods.

The Role of Trust in Future Ventures:

How a founder closed out their last venture journey with their stakeholders will play a massive role in how much they will be trusted in their next journey. So, take responsibility for the money you have raised and set systems to ensure you do not run out. However, if things do not work, as it happens sometimes, ensure everyone is not paying the price.

Conclusion:

In conclusion, founders must prepare for their company's financial challenges. Being proactive in managing finances, setting up systems to monitor cash flow, and making tough decisions, when necessary, can make all the difference between a successful venture and a rather disastrous one. In addition, by taking responsibility for the money raised and ensuring that all stakeholders get considered in the decision-making process, founders can protect their company's future and maintain the trust and support of their team, investors, and customers.

Remember that it's always better to prepare for the worst and hope for the best!